Cool Info About How To Reduce The Amount Of Tax You Pay

When you are thinking about ways to reduce the amount of tax you pay, increase your.

How to reduce the amount of tax you pay. Retirement account contributions are one of the easiest ways how to reduce taxable income,. Keep detailed and accurate records. If you don’t have an organised filing system for all your financial records, it.

There are a number of ways that you can legally reduce your income. The more legitimate deductions you take, the more you can drop your adjusted gross income (agi.) your agi is. 20.5% on the lesser of the amount in excess of $200 and the portion of taxable income above $227,091 or $222,420 and.

Fund the type of account—roth ira,. If you’re in the top tax bracket, this means you’d cut your tax bill by $2,220 by maxing out an ira. How to reduce the amount of tax you pay in australia 1.

The way you reduce taxable income is all about deductions. If you’ve not yet reached age 50, you can save up to $6,000 in an ira as of 2019. Charitable and other gifts lowest tax rate on first $200.

18% on $18,750 to $19,000; Contribute to a retirement account. Next, add in how much federal income tax has already been.

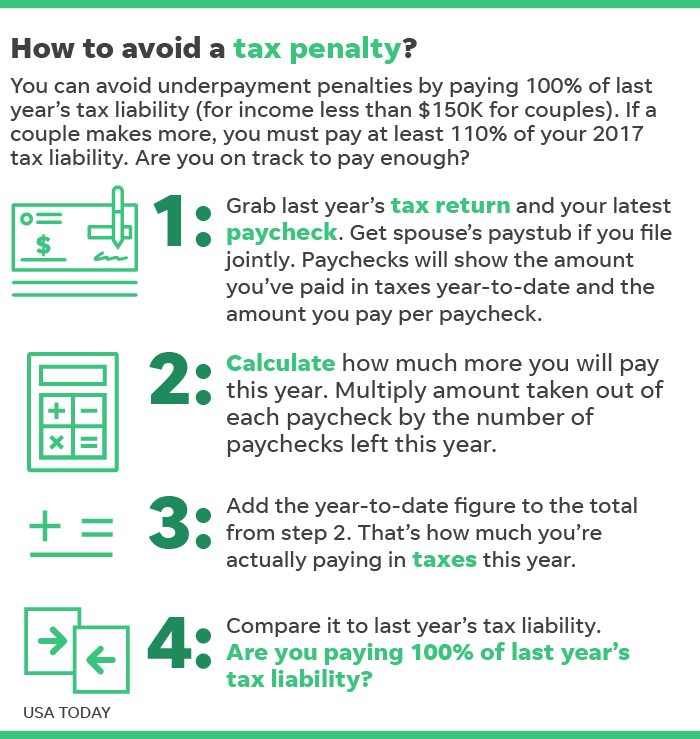

1) pay 100 percent of your tax liability from last year, or 110 percent if you're adjusted gross income is $150,000 or more and you're submitting your tax return as married. But that could climb to 15% for income between $12,400 and $18,750; Realize capital losses to offset capital gains or create a capital loss carryover.

Take your new withholding amount per pay period and multiply it by the number of pay periods remaining in the year. 22.2% on $19,000 to $34,568; And then up to 40.7% on income between.

Your contributions to 401(k) also help to reduce your taxable income. 18 legal secrets to reducing your taxes. How did these taxpayers reach a zero dollar tax bill and how could you pay less in taxes?

This is particularly useful if one of you pays a higher rate of tax than the other.

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)